how to pay indiana state tax warrant

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check. Doxpop provides access to over current and historical tax warrants in Indiana counties.

Indiana State Tax Information Support

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

. Payment by credit card. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices.

Have more time to file my taxes and I think I will owe the Department. Find Indiana tax forms. Generally in order to establish a payment plan the amount of tax due must be greater than 100.

You must include Your county and warrant number with all correspondence. Take the renters deduction. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC.

SF 56196 Expungement Request Form. Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Paying one-third of the total amount due within the 20-day response period will provide a new notice with a new 20-day due date. Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. As part of the Tax Amnesty 2015 program eligible taxpayers are allowed to submit a request to have tax warrants expunged. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability.

Property that is illegal to possess. If you set up an IPA the warrant will remain on file. A service fee will be charged.

Claim a gambling loss on my Indiana return. INtax only remains available to file and pay the following tax obligations until July 8 2022. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action.

Find Indiana tax forms. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxe.

The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. We will also notify the Department of State that the tax warrant has been satisfied. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail.

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. What is a tax warrant. Thanks to efforts over the last nine years that have allowed Indiana to fund critical needs while maintaining our states competitive tax environment many Hoosier taxpayers will receive a one-time 125 taxpayer refund under Indianas Use of Excess Reserves lawMore information including eligibility is available on DORs Automatic.

Hamilton County Sheriffs Office 18100 Cumberland Road. The filing information is then sent back to the DOR electronically so staff there can send the 3 per filing payment to the Clerks. You must pay your total warranted balance in full to satisfy your tax warrant.

How do I pay my Indiana state tax warrant. Property that constitutes evidence of an. Our service is available 24 hours a day 7 days a week from any location.

How do I get my IRS debt forgiven. Step 1-Walk up to Police Station Step 2-Show ID and ask if you have any warrants. INcite picks up the file and creates an electronic Judgment Book record of the filing.

However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. Know when I will receive my tax refund. Property is possessed by a person who wishes to use it to commit a crime or hide it to prevent the discovery of a crime.

Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. Using the e-Tax Warrant application the DOR provides an electronic file with tax warrants to be processed by Circuit Court Clerks. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. 125 Automatic Taxpayer Refund Information. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

Saved Tax Warrant Searches. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. You should also know the amount due.

If a faulty payment is submitted such as a bad check a penalty will be incurred. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt.

Set Up a Payment Plan. Paying one-half of that notice within the 20-day response period will provide another new notice to pay the balance in full within the 20-day time frame. Pay my tax bill in installments.

To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. DOR has an online payment system through INTIME that allows taxpayers to set up a payment plan and or pay their bill in full. The data or information provided is based on information obtained from Indiana Courts Clerks Recorders and Department of Revenue and is.

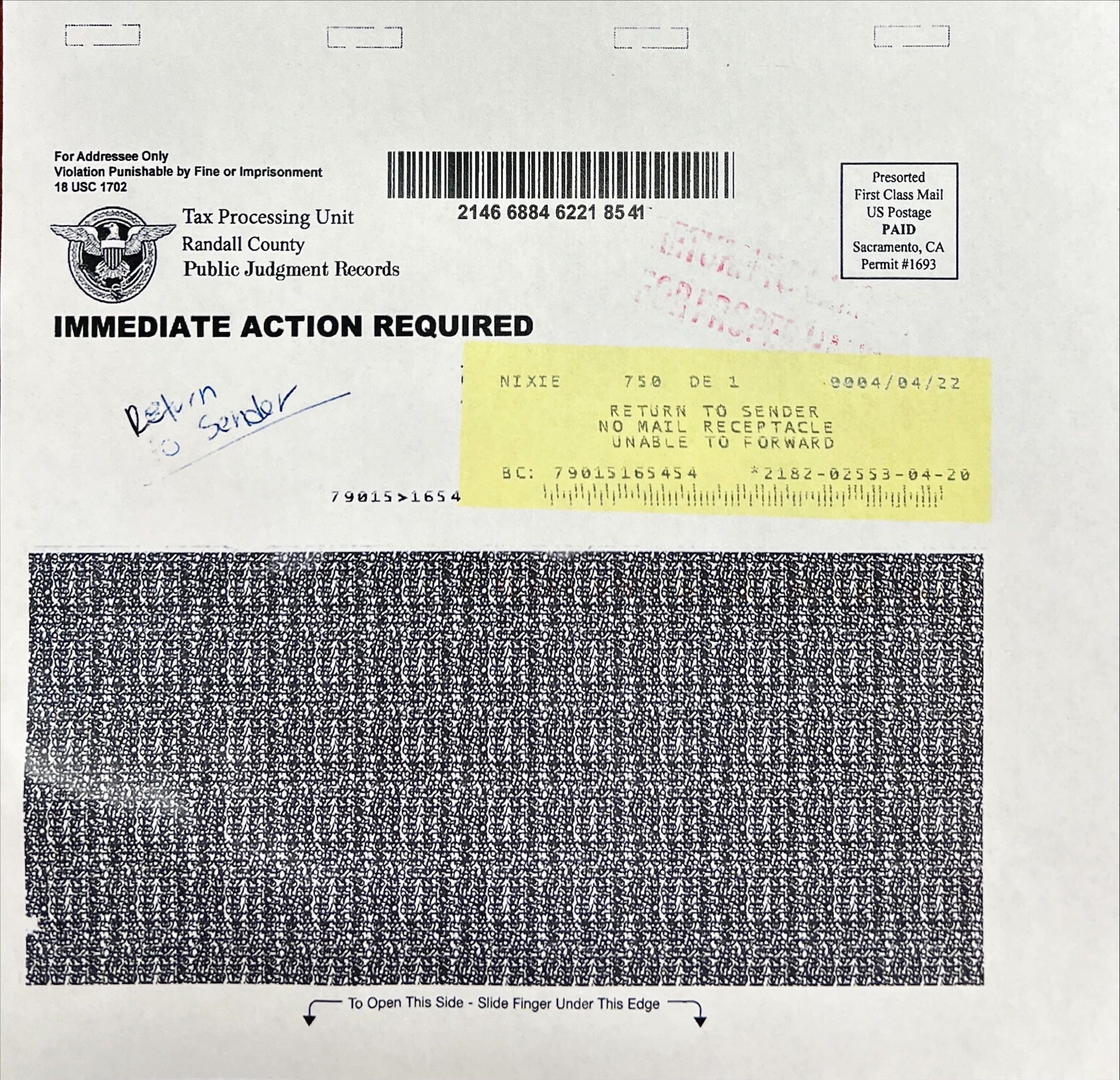

Randall County Sheriff S Office Warns Of Tax Debt Letter Scam

Dor Owe State Taxes Here Are Your Payment Options

Dor Owe State Taxes Here Are Your Payment Options

New Records Reveal Epic Charter Schools Sponsor Was In Touch With State Auditor For Months Before Scandal Charter School Virtual School State School

Dor How To Make A Payment For Individual State Taxes

Zero Sette Archtop Red Reverb Guitar Design Cool Things To Make Cool Guitar

Dor How To Make A Payment For Individual State Taxes

Tammy Tschetter Taxpayer Advocate Director Indiana Department Of Revenue State Of Indiana Linkedin

Dor Make Estimated Tax Payments Electronically

The Metropolitan Museum Of Art Spoon Antique Silver Antique Collection Antiques

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Earcandy 20 Watt 8 Ohm Mini 1x6 Guitar Amp Speaker Cab W Jtm45 Grill Chrome Hardware For Greta Amp Reverb In 2022 Speaker Cab Guitar Amp Guitar